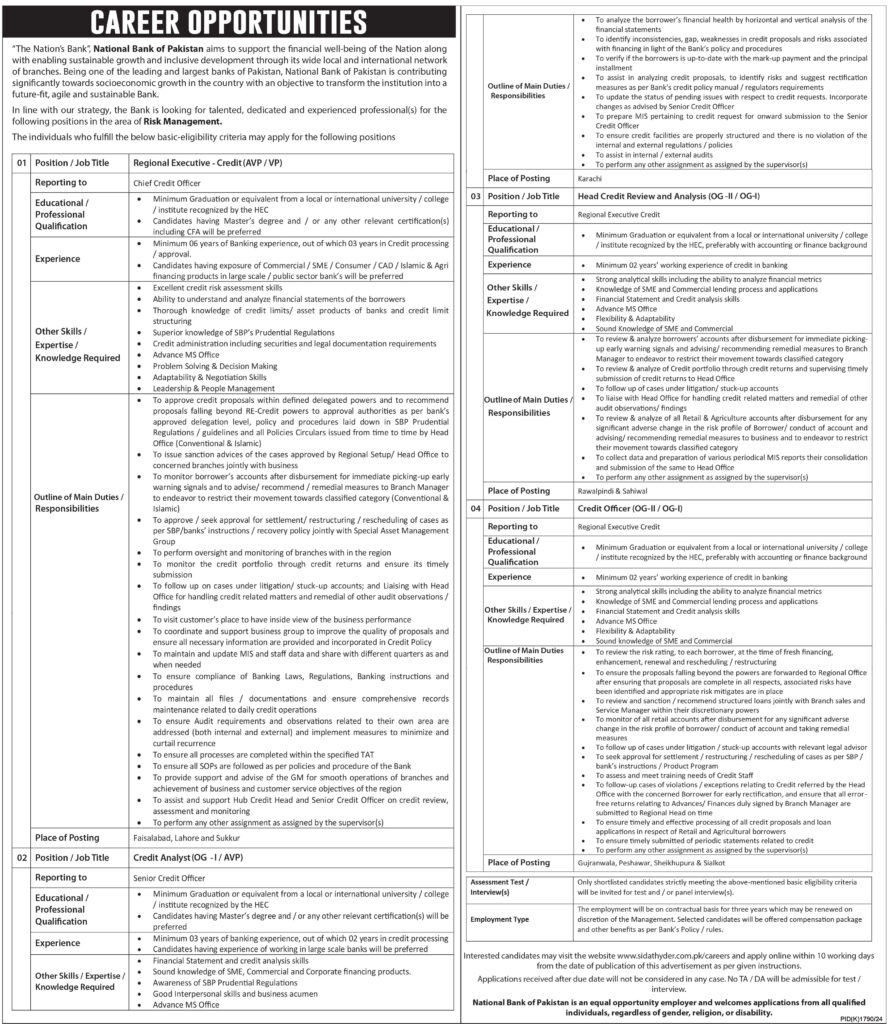

National Bank of Pakistan (NBP) is seeking qualified candidates for various management positions, including Head Credit Review Analysis, Credit Officer, Regional Executive, and Credit Analyst. These roles provide an opportunity to contribute to the growth and success of one of Pakistan’s leading financial institutions. The positions are based in multiple locations across Punjab, with temporary employment options available.

Key Responsibilities:

- Head Credit Review Analysis:

- Oversee and manage the credit review process for loan and credit portfolios.

- Ensure that all credit policies and procedures are followed.

- Conduct regular risk assessments and prepare comprehensive reports for senior management.

- Lead the credit review team and manage complex credit-related issues.

- Credit Officer:

- Assess the creditworthiness of clients and process loan applications.

- Review financial statements, reports, and documents to determine loan eligibility.

- Maintain accurate records of credit transactions and follow up on payments.

- Collaborate with other departments to ensure proper credit management.

- Regional Executive:

- Oversee branch operations and ensure alignment with bank policies and goals.

- Manage regional sales and service functions.

- Develop and implement strategies to improve operational efficiency and customer satisfaction.

- Monitor and report on key performance indicators for regional branches.

- Credit Analyst:

- Analyze financial data and assess credit risks for loan applications.

- Prepare detailed reports and recommendations based on financial analysis.

- Ensure compliance with regulatory requirements related to credit approvals.

- Collaborate with teams to evaluate and manage credit portfolios.

Qualifications:

- Required Education: Bachelor’s or Master’s degree in Finance, Banking, Business Administration, or a related field.

- Relevant experience in credit analysis, banking operations, or financial management is preferred.

- Strong analytical skills with the ability to assess financial risks.

- Proficiency in Microsoft Office, particularly Excel, and banking software.

- Good communication and interpersonal skills to work effectively with clients and colleagues.

- Additional certifications (such as banking-related qualifications) may be a plus (discuss during the interview).

Benefits:

- Competitive salary based on qualifications and experience.

- Opportunity to work with a leading government institution.

- Professional development and career growth opportunities.

- Health and wellness benefits (discuss during the interview).

- Exposure to various aspects of banking and credit management.

- (Additional benefits to be discussed during the interview).

Application Instructions:

Interested candidates should submit their updated CV, including relevant qualifications, work experience, and certifications. Applications can be submitted via:

WhatsApp Channel: Join Now for updates and quick communication.

Be among the first 25 applicants to increase your chances of securing an interview.

Note: Ensure that your CV is up-to-date, complete with educational qualifications, work experience, and certifications.